Leuthold Global Fund

Morningstar Rating™ Overall among 407 Global Moderate Allocation funds as of 12.31.25 based on risk-adjusted returns.†

| NAV | YTD | Inception | |

|---|---|---|---|

| Retail (GLBLX) | $9.75 ($0.02) | 5.52% | July 2008 |

| Institutional (GLBIX) | $9.96 ($0.02) | 5.51% | Apr 2008 |

Overview

- We believe the most important decision is proper asset class selection and a highly disciplined, unemotional method of evaluating risk/reward potential across investment choices.

- We adjust the exposure to each asset class to reflect our view of the potential opportunity and risk offered within that category.

- Flexibility is central to the creation of an asset allocation portfolio that is effective in a variety of market conditions. We possess the flexibility and discipline to invest where there is value and to sell when there is undue risk.

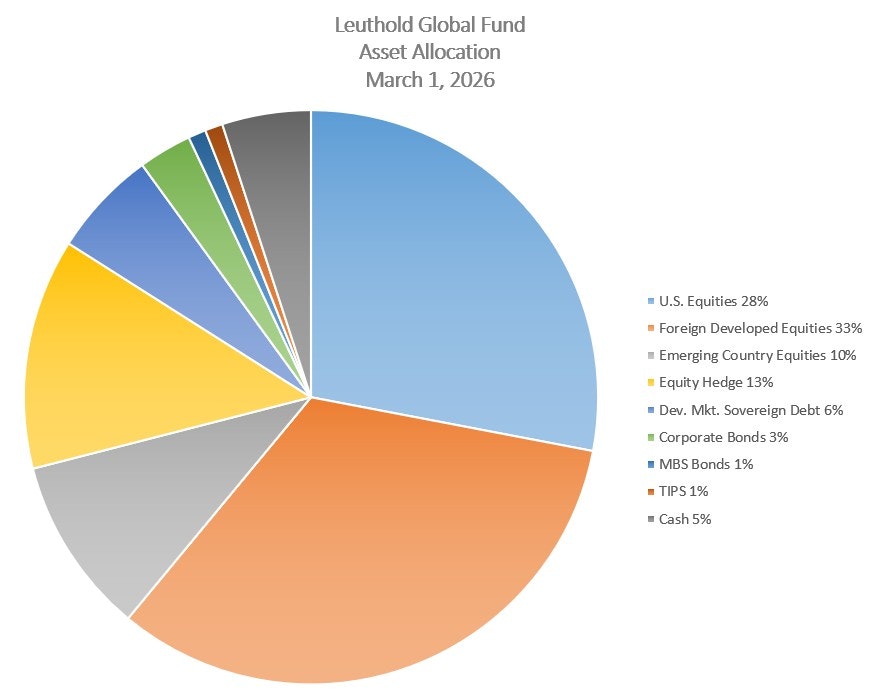

The investment guidelines of the Leuthold Global Fund follow a 30%-70% Equity Exposure and 30%-70% Fixed Income Exposure. Additionally, at least 40% of assets will normally be invested in securities from international markets.

Download the quarterly report to get the latest update in printable form on the Leuthold Global Fund including performance, statistics, and commentary.

Quarterly Report

Performance

| Performance as of 12/31/2025 | GLBLX | GLBIX | MSCI ACWI (Net) | 50% MSCI ACWI (Net)/50% BBG Global Agg. | Bloomberg Global Agg. |

|---|---|---|---|---|---|

| December | 1.97% | 2.06% | 1.04% | 0.65% | 0.26% |

| Q4 | 2.61 | 2.69 | 3.29 | 1.76 | 0.24 |

| YTD | 17.34 | 17.72 | 22.34 | 15.18 | 8.17 |

| 1 Year | 17.34 | 17.72 | 22.34 | 15.18 | 8.17 |

| 3 Year | 8.53 | 8.82 | 20.65 | 12.12 | 3.98 |

| 5 Year | 6.24 | 6.42 | 11.19 | 4.46 | -2.15 |

| 10 Year | 4.99 | 5.20 | 11.72 | 6.58 | 1.26 |

| 15 Year | 4.69 | 4.90 | 9.81 | 5.67 | 1.14 |

| Since Inception (GLBLX-7/1/2008) | 4.77 | - | 8.29 | 5.24 | 1.76 |

| Since Inception (GLBIX-4/30/2008) | - | 4.88 | 7.73 | 4.89 | 1.67 |

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment returns and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. For performance data current to the most recent month-end, please call Leuthold Funds’ Shareholder Services, toll-free: 1-800-273-6886.

Bloomberg Barclays Global Aggregate Index provides a broad-based measure of global investment grade fixed-rate debt markets. MSCI ACWI (net) is designed to measure equity market performance of Developed and Emerging Markets. These are indexes only and cannot be invested in directly. Fund performance return figures are historical and reflect the change in share price, reinvested distributions, change in net asset value, and capital gains distributions, if any.

MSCI ACWI (net) is designed to measure equity market performance of Developed and Emerging Markets. This is an index only and cannot be invested in directly. Performance return figures are historical and reflect the change in share price, reinvested distributions, change in net asset value, and capital gains distributions, if any.

- The Bloomberg Barclays Global Aggregate Index and MSCI AC World Index are indexes only and cannot be invested in directly. Fund performance return figures are historical and reflect the change in share price, reinvested distributions, change in net asset value, and capital gains distributions, if any.

Expense Ratio Disclosure: Per the Prospectus dated 1/28/2025, excluding dividends on short positions and acquired fund fees and after expense reimbursement, annual net operating expenses for GLBLX/GLBIX were 2.04% / 1.79%; gross operating expenses including dividends on short positions and acquired fund fees, and after expense reimbursement, were 2.32% / 2.07%. The Adviser has contractually agreed to reimburse the Fund for ordinary operating expenses >1.85%. In any of the following three fiscal years, the Adviser may recover waived fees. Current contract runs through 01/20/2027. Please refer to the Prospectus for a more detailed explanation of the expense ratios.

Fund Information

| Symbols (Retail/Institutional): | GLBLX /GLBIX |

| Individual Retirement Account (IRA): | $1,000/$100,000 |

| Regular (non-IRA) Account: | $10,000/$100,000 |

| CUSIP: | 56167R879 /56167R861 |

*Risks of Investing

As disclosed in the prospectus, the risks of investing in

the Fund include,

but are not limited to, interest rate risk, market risk, short sale risk, high portfolio turnover

risk, currency risk, foreign securities risk, emerging markets risk, foreign securities risk, asset allocation

risk, and quantitative investment approach risk. Investing in foreign securities presents risks that may

be greater than U.S. securities. These risks include, but are not limited to, currency rate fluctuations,

regulatory differences, accounting standards, higher trading costs, and political risks. Please read the

prospectus carefully before you invest (1-800-273-6886).

† Morningstar Rating™ or “star rating”: For funds with at least a 3-yr history, a risk-adjusted-return measure is calculated to account for variation in monthly performance, placing more emphasis on downward variations and rewarding consistency. The top 10% of funds in each category receive 5 stars, next 22.5%=4 stars, next 35%=3 stars, next 22.5%=2 stars, and bottom 10%=1 star. The “Overall” Rating is derived from a weighted average of the 3-, 5-, and 10-yr ratings. Within the Global Moderate Allocation category, for the 3-, 5-, and 10-yr periods, respectively, GLBLX (GLBIX) are rated 1 (1), 3 (3), and 1 (1) stars among 407, 394, and 320 funds. ©2025 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from using this information. Leuthold Funds’ adviser pays a license fee for the use of Morningstar Ratings™.